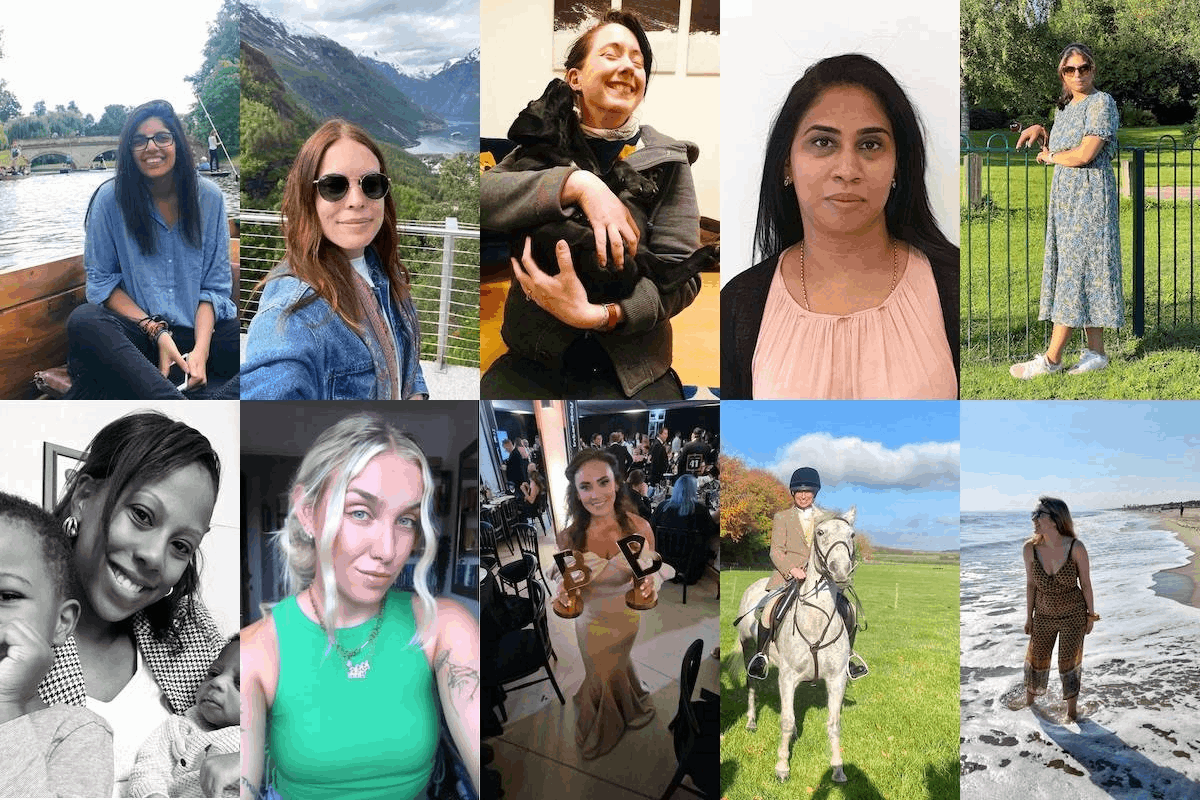

For International Women’s Day 2023, we wanted to gather together the stories of how some of the fantastic women at Allica got into fintech.

Fintech is a notoriously male-dominated environment, so it’s important to share how women of all backgrounds and lifestyles can be successful in the sector – and hopefully encourage others to do the same!

Find out about our team’s journeys below, and some lessons they have learned along the way.

Emily Johnson – Head of Operations

I began my career in a big bank – so it’s fair to say there was more ‘fin’ than ‘tech’! As my career has progressed, I’ve moved to smaller firms with a faster pace of change and, with that, more opportunity to make an impact. And this is one of the things I love about Allica and fintech as a whole.

I am obsessed with driving continuous improvement for our customers through automation and building best-in-class technology, all while enhancing our human relationships with our customers. And thanks to how fast we move at Allica, there are so many wins to celebrate.

Before getting into fintech, I always thought you had to be an absolute tech whizz to be successful in the sector. But the reality is that it needs a diversity of skillsets as much as every other business. The fact I don’t know how to code means I ask different questions than those that do. I can approach a problem in the same way as a customer, who will likely have as much knowledge of Python as I do!

My mission is to build the best operations team of any SME bank in the UK, and it’s only with a diverse range of skills and experiences that we’ll be able to do that.

Tami Reichold – Front-end Engineer

My journey into fintech was more of an accidental - or belated - one. In 2019, I switched from working in HR to engineering. Being new to coding, this was challenge enough in itself. And I never thought I’d be good enough to get into fintech, being such a mathematically complex and competitive sector (imposter syndrome was at its highest!).

Fast-forward a couple of years and I found myself looking for a new role again. Allica’s HR partner, Chloe, reached out to me. She and Allica’s recruitment process put me at ease with what’s expected from the engineers and how the company works in general. And that’s when I decided to give it a go, at last.

Now I’m a few weeks into my role here at Allica and in fintech and the biggest lesson so far has been: if you’re not sure about whether fintech (or any other industry) is the place for you, reach out to someone and speak to people who are, or have been, working in this area to find out more and overcome any mental obstacles you might have. You might be surprised about what you’re hearing and the impressions that you’ll get!

Ravneet Shah – Chief Technology Officer

![Ravneetjpg[43]](https://www.allica.bank/hs-fs/hubfs/Ravneetjpg%5B43%5D.png?width=500&height=500&name=Ravneetjpg%5B43%5D.png)

As an engineer myself, I’ve always had a passion for trying something new or different, and this was exactly what fintech was to me before I got into the sector – something new that I wanted to try. The only difference this time was I loved it so much I never left!

I have worked in many tech companies over the years, and most of the time the people we were serving were other techies. Which was fine. But in fintech, I get so much satisfaction at the end of each day knowing I am directly making a difference to real businesses, and all the people they employ and serve. Every day brings with it a new problem to solve, and I love working out how to tackle it.

Leona Brown – Underwriter

At 17, I took up an apprenticeship at Nationwide Building Society. I was always pretty good at maths and also really enjoyed working with people, so a customer-facing apprenticeship at a bank seemed like the perfect fit for me. At the time, apprenticeships had only just been introduced as an option for further education, so I was really pleased to get in as spaces were scarce.

From there on I worked across a number of roles and eventually entered the world of underwriting, and then also fintech. It was a bit of an accident, really, but I haven’t looked back since!

My journey into fintech taught me that you don’t need all the qualifications under the sun to make your way up the ladder. As long as you have the drive and determination to succeed, you will go far. I have met some of the most amazing women throughout my career – in fact, now I think about it, all the managers I’ve had that have pushed me to where I am today have been female. You can do anything when you put your mind to it!

Ashanta Charm – Operations Manager, Lending

I was drawn to fintech because it is exciting, innovative and fast-paced. As a sector, I have always felt like I can make a real, visible and tangible difference in it. This fitted perfectly into my personal five-year plan, which has allowed me to flourish and create a real expertise in the field.

I am also really proud to be an example to other parents that want to get into fintech that a career break doesn’t have to break your career. In fact, I have learned so much from being a mum that has helped me excel in fintech. Whether it’s being a team-player with my husband, showing empathy, motivating people to be the best they can be, having a knack for persuasion or being able to give constructive support – these qualities are equally (if not more) important in the workplace.

Not to mention, multi-tasking – which is absolutely vital if you’re part of a team building an industry-leading bank!

Emma Lane – Head of Relationship Management

I have been in banking for over 20 years, including working for a couple of the high-street monoliths. But I jumped at the opportunity to enter fintech and join Allica. I am passionate about business and the economy, and believe that the UK’s SME community is the lifeblood of that in the UK. Allica offered an opportunity to give these businesses something different, by walking the walk and not just talking the talk about putting them first.

Allica is like nowhere I have ever worked before. The pace we work at, the commitment to deliver and the way we empower our colleagues is incredible. We must work hard to maintain the collaborative culture we have, beginning with our flat structure and the mindset that anything can be achieved in short sprint bursts.

It’s fantastic that Allica is celebrating International Women’s Day, and women’s equality in all its forms.

Sheliza Siddiqui – Credit Risk Quant

When I studied maths at university, I remember having this moment of realisation – ““wow, I can statistically model the likelihood of something actually happening, and how major decisions could affect our society!”.

After leaving university, I landed straight into a fintech startup, and my passion for working with financial risk data grew. It’s been 6 years since then, and I’ve never looked back!

I’d recommend any women getting into fintech to stay grounded, curious, and keen to learn. It’s a fast-moving industry and there needs to be a willingness to try new things, stay ahead of trends and don’t be afraid to fail. Although fintech can be a highly pressured environment, having the right mentality can help you achieve great things, so remember to encourage others, share knowledge and – most importantly – give out positive vibes!

Read more about Sheliza's story here.

Tonje Hauge – Growth Finance Operations Manager

I’ve been in the financial services industry for nearly 10 years, but Allica is my first fintech. I was introduced to the Allica team through my professional network, and was really excited about the prospect of being part of a bank combining great technology with relationship-based lending, and creating new, innovative products for UKs SMEs. Allica are truly disrupting the market and challenging the norm of how traditional SME lending is done.

The fintech industry is extremely fast paced and during my 6 months at Allica I have been exposed to an environment of rapid product development. The learning curve is steep and I have had to accept that I have a lot to learn. I have personally found that the best way to develop and increase my knowledge is to get involved, even if it is in areas that on the outside can seem very challenging. Asking questions and leveraging other people’s knowledge is a great way of learning, building a strong network and relationships with colleagues.

Charissa Chang – Business Development Director, North

My journey into fintech wasn’t planned, to be honest! But, in twenty years in financial services, I have always found the ratio of women to men both fascinating and frustrating, and that hasn’t changed as much as it should have in that time.

I am of the mindset that if you want to change things you have to do something about it – so, for me, I am going to continue to push myself to be a strong female leader in our industry.

Both in and outside of work, we can’t go wrong if we treat eachother with respect. I am a believer in being open, honest, and standing up for what is right. And these values have helped me build some strong relationships with colleagues and clients over the years.

I have also learnt not be afraid of a challenge, whether it be a personal milestone or work goal – do it, no regrets, tomorrow is never promised!

Kalpana Varsani – Head of Analytics

Data has been part of my DNA from day one of my career. Having primarily worked for big banks before Allica, I had grown frustrated with the legacy systems you have to deal with. Fintech represented an opportunity to shake that off and deliver at pace, meaning I’d also get to work on more projects. That’s why I was so excited when the role at Allica came up, especially as their company values also really resonated with me.

For any women looking to get into fintech, I’d give four bits of advice:

- Sometimes, the boring stuff is the most useful and provides the best foundations. Give them the attention they deserve.

- Expand your business knowledge by speaking to people outside of your direct team. People that work in tech can often silo themselves.

- Be open to moving out of your comfort zone, even in larger organisations these opportunities are available.

- Don’t be afraid to ask questions about why something has been done a particular way. Challenge things, and don’t take “that’s just the way it’s always been done” for an answer.