At the turn of the year (not quite as the clock struck 12!), I had a conversation with Blair Miche, the owner and Managing Director of Commercial and Asset Finance Ltd.

I wanted to get Blair’s perspective on asset finance in the year ahead, what the challenges might be, and how he thinks banks and brokers can overcome them.

Given that Blair started his brokerage in 2008, it’s safe to say he’s no stranger to challenging market conditions!

Below, I’ll share the insights Blair gave. Let’s dive in…

What were the main challenges brokers faced in 2022?

As many brokers would agree, the big challenge in 2022 that Blair highlighted was shortage of stock. This was a story told across the UK and internationally, as a confluence of global events put pressure on different sections of the supply chain, creating bottlenecks and seeing demand far outstrip supply.

The result was that vendor private sale deals, whether that’s “one operator selling to another operator, or one company selling to another”, skyrocketed. And, due to the lack of product availability, Blair also handled “a lot more secondhand deals, rather than new”.

Brokers benefited because there was less competition from dealer finance (keeping severely subsidised pricing out of the picture), but also because traditional banks have been reticent to touch any deals with a slightly abnormal shape or structure. Financing for secondhand deals from one of the big five is rarer than hen’s teeth, so brokers have really been able to add value by helping their clients secure funding for (relatively) abnormal deal structures.

It’s also critical to mention that CBILS loans came to an end. The end of CBILS has been “a slightly sore one” for Blair’s customers, who are now making full repayments. With the recent rate increases, it’s caused a bit of uncertainty and turmoil for businesses that were still leveraging CBILS.

Why asset finance is such a crucial tool for businesses

“You’d be absolutely bonkers to go out and spend £250,000 of your own cash on a piece of equipment.”

Blair’s not one to mince his words, as you might be able to tell!

Cash flow is a fundamental for financial health and few businesses are in a position to grow their business and add assets as cash buyers. Even if they are cash rich, it’s rarely the smartest choice when reasonable lending terms exist.

And, of course, it’s not just about lending terms. Blair highlighted the 130% capital allowances for plant and machinery purchases, which are in place until the end of March 2023 (“and, touch wood, they’re going to extend it”).

In many ways, there’s never been a better time to invest in equipment and other assets, Blair said—asset finance makes this possible for more businesses.

Plenty of Blair’s customers are buying equipment to support a new project or contract, “so, that’s incrementally got a big cash benefit to their business, with finance provisions included in their budget. That’s why asset finance is the way to go.”

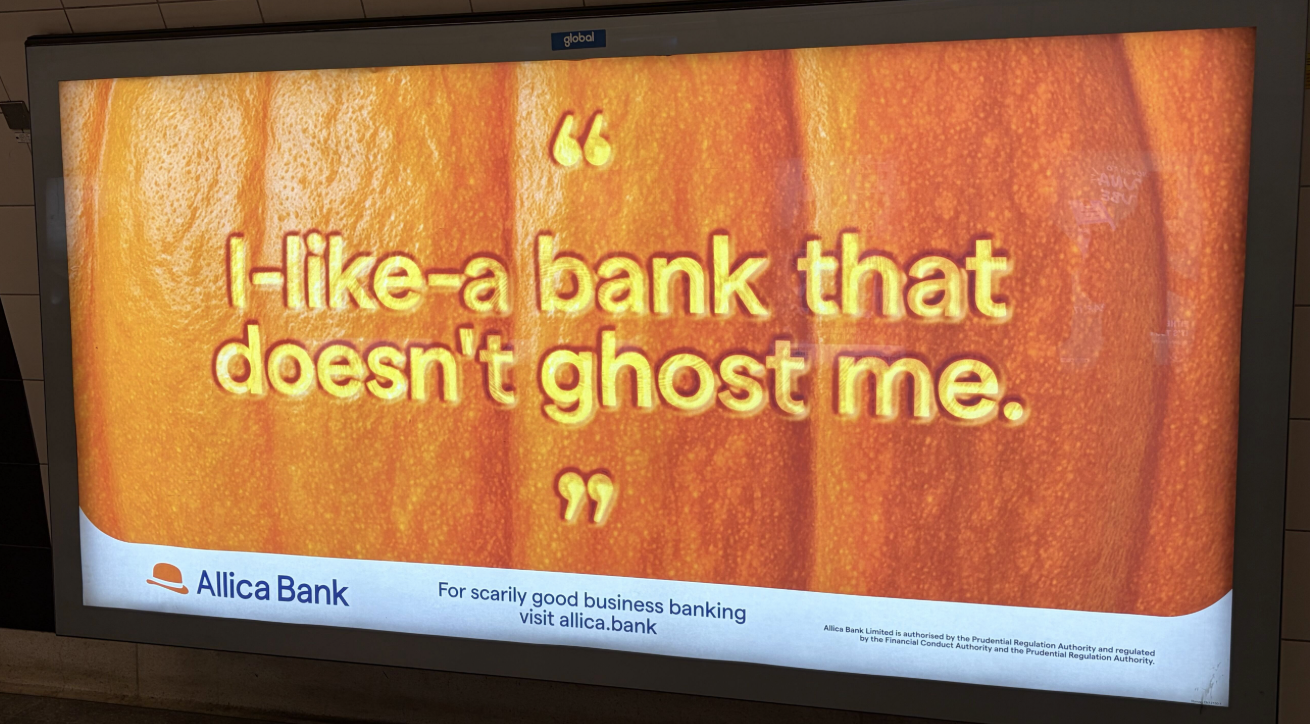

We’ll talk more about the market conditions for 2023 in a moment, but it’s worth adding here a point that Blair made about the different approaches of funders in a recession. Banks with a commercial perspective are hugely valuable in challenging economic conditions. Certain funders have become “a bit negative and retrenched with their underwriting because things are getting tighter”. That’s understandable, but it’s a blanket approach that holds some SMEs back from growth opportunities.

Having a funding partner who sees space for commercial upside in a complex market can be critical to turning the tide.

The challenges across asset finance in 2023

Blair’s outlook for the asset finance industry, he’s happy to admit, is coloured by his positive attitude. That being said, he admits that Q1 is going to be challenging. Things are slowing down quickly, which, coupled with the fact that “January is always a long month and people are always chasing money”, means the year is starting on a tricky note.

With a weak Q1 in mind, Blair predicts that “certain products will become really invaluable: we’ll get an upsurge in tax and VAT loans and refinance is going to be absolutely massive.”

As any broker will tell you, it ultimately depends on the customer. “Some are organised and see the curve before it comes. They’ll contact you in advance and say: ‘We envisage we’ve got a bit of a cash flow shortage in a few months time, can we put something in place?’

“And there are others, who phone us up and say they’ve not got money to pay their wages next week—that puts a bit of strain on us!”

Blair’s big-picture predictions for the year are:

- 2023 will be the year of refinance. (“The funders that offer this product are going to really see the benefit in terms of their business volumes.”)

- Invoice finance, as well, will become increasingly popular.

- Redundancies and a cooling hiring market will create a rise in new businesses and self-employed ventures.

Blair’s concluding words felt pretty timeless: “it’s a case of trying to look after your customer and making sure their cash flow is okay.”