Your iPhone is now your Allica Bank card.

An easy, secure, and private way to pay.

Apple Pay lets you make purchases with your Allica Bank card using any Apple device,

just like you would with your physical card, in store, online and in apps.

Add it once. Use it everywhere.

Apple Pay is built into iPhone, Apple Watch, Mac, iPad and Apple Vision Pro. Once you add your Allica Bank card to Apple Wallet on your iPhone, you can easily add it to your other Apple devices — just open Apple Wallet on the new device and follow the on-screen instructions.

Shop in person. Online. Or use your card in apps.

Apple Pay is accepted by millions of merchants around the world. Just look for the Pay symbol or the contactless payment symbol at checkout and pay with your Allica Bank card. To check out with Apple Pay if you’re on a computer but not using Safari or a Mac, click the Pay button and scan the code that appears onscreen with your iPhone

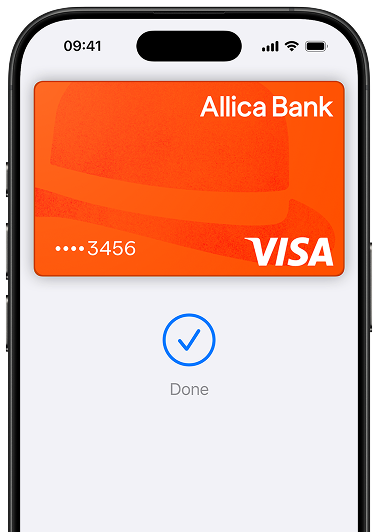

Tap. Pay. Done.

Apple Pay lets you skip entering your address or CVC code at checkout — tap the Pay button, select your Allica Bank card and confirm your purchase.

Designed to be secure. So only you can pay.

Every Apple Pay transaction requires authentication through your devices built-in security features, including Face ID, Touch ID and your passcode. Your debit or credit card number is never shared with merchants or stored on Apple servers. And if you misplace your iPhone, you can quickly mark it as lost in Find My to suspend your Allica Bank card.

How to Add a card

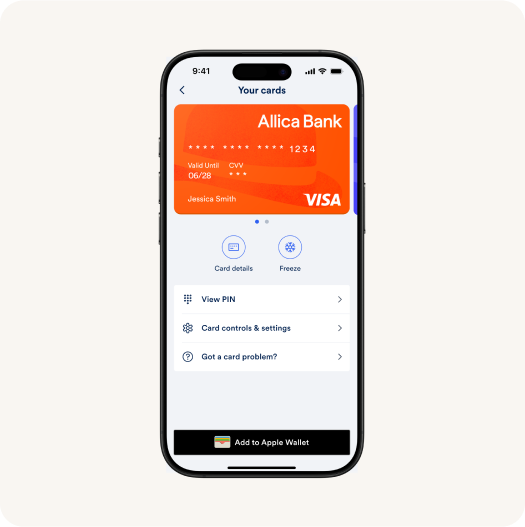

To add your card through the Allica Bank app:

- Log in to the app.

- From the dashboard, go to ‘Cards’.

- Select the card you’d like to add.

- Select ‘Add to Apple Wallet’.

You can also add your Allica Bank card to Apple Wallet directly through the Apple Wallet app by following the on-screen instructions.

The card benefits you love. With Apple Pay.

Enjoy the same rewards you love: use your Allica Bank card with Apple Pay and keep earning up to 1.5% cashback.1

1 Cashback is variable and based on card spend. Exclusions apply. See a full list of limits and fees here.

You’ve got questions.

We’ve got answers.

Which devices work with Apple Pay?

You can use Apple Pay on most modern Apple devices. That includes iPhone 6 and later in stores, apps and Safari; Apple Watch (when paired with iPhone 6 or later) in stores and apps; and iPad Pro, iPad (5th generation), iPad Air 2 and iPad mini 3 or later in apps and Safari. You can also use Apple Pay on Macs from 2012 or later when using Safari and paired with an Apple Pay-enabled iPhone or Apple Watch. For the full list of supported devices, check Apple’s support page.

How do I add my Allica card to Apple Pay?

To add your card through the Allica Bank app:

- Log in to the app

- From the dashboard, go to ‘Cards’

- Select the card you'd like to add

- Select ‘Add to Apple Wallet’

You can also add your Allica Bank card to Apple Wallet directly through the Apple Wallet app by opening Apple Wallet, clicking on the + icon and following the on-screen instructions.

How many devices can I add my Allica Bank card to with Apple Pay?

You can add your Allica Bank card to up to three devices at any given time. This includes both Android and Apple devices (phones and watches).

How do I make my Allica card the default one in Apple Pay?

Just press and hold your Allica card in Apple Wallet, then drag it to the front of your stack.

Where can I use Apple Pay – does it work abroad?

Yes – you can use Apple Pay anywhere that takes contactless, in the UK and overseas. Just look for the contactless or Apple Pay logo at checkout.

Can I use Apple Pay online or in apps?

Yes – you can use your Allica Bank-linked Apple Pay anywhere Apple Pay is accepted, including in many apps and websites. Just select Apple Pay at checkout.

Why can’t I see the “Add to Wallet” button in the Allica Bank app?

If you don’t see the “Add to Wallet” button in the Allica Bank app, it could be because your card is already added to Apple Wallet on that device, or because you’ve reached the limit of three devices. Please note: you can add your Allica Bank card to a maximum of three devices.

If you have any questions, please email our customer services team at customer.services@allica.bank, or call us on 0330 094 3333.

Is there a limit on how much I can spend with Apple Pay?

There’s no spending limit set by Apple. Some merchants might have their own limits, though.

Why do I get two notifications every time I use Apple Pay?

You’ll get one from Apple Wallet and one from us. If you’d rather not see both, you can turn off Apple notifications in your device settings.

Can I still use Apple Pay if I freeze my Allica card?

No – freezing your card in the Allica app also stops it from working with Apple Pay.

What happens if I lose my phone or Apple device?

If you lose your phone or Apple device you can use the Find My app on another Apple device to keep your cards safe. To do so, access the ‘Find My’ app and choose ‘Mark as lost’ to suspend your cards. Alternatively, use your iCloud account to remove your Allica card from Apple Pay.

What if I lose my Allica card – can I still pay with Apple Pay?

If you lose your card, freeze it in the Allica app which will stop it from working with Apple Pay. Once you found it, unfreeze it and Apple Pay will work again.

Is Apple Pay safe to use?

Yes. Your Allica card details aren’t shared when you pay – Apple Pay uses a secure device-specific number and Face ID or Touch ID.

Is there a fee for using Apple Pay?

No – we won’t charge you to use Apple Pay. Standard card fees and limits still apply.

Can I add more than one Allica card to Apple Pay?

Yes – you can add multiple cards and choose which one to use when you pay.

Will Apple Pay work if I’ve got no signal or Wi-Fi?

Yes – just make sure your Apple device just make sure your phone or watch has enough battery.

Will I still earn cashback if I pay with Apple Pay?

Yes – you’ll earn cashback whether you use your physical card or Apple Pay. So you can tap your phone or watch and still get up to 1.5% cash back on what you spend. Cashback is variable and based on card spend. Exclusions apply. See a full list of limits and fees at www.allica.bank/fees/rewards-account-fees-and-limits.

Expand for more answers +

Help, my question isn’t answered here.

Don’t worry, find the answer in our Help Centre or speak to our team on 0330 094 333

Apple Pay in more browsers: Available with participating merchants on compatible browsers. Compatible browsers require WebSocket support. This feature is not available in all markets. Software requirements apply. To ensure you have all features of this product, update your iPhone or iPad to the latest software version.

Apple Pay is a service provided by Apple Payments Services LLC, a subsidiary of Apple Inc. Neither Apple Inc. nor Apple Payments Services LLC is a bank. Any card used in Apple Pay is offered by the card issuer.

To use Apple Pay, you need a supported card from a participating card issuer. To check if your card is compatible with Apple Pay, contact your card issuer.

Apple Pay is not available in all markets. See apple.com/uk/ios/feature-availability/#apple-wallet-apple-pay for more information.

Features are subject to change. Some features, applications and services may not be available in all regions or all languages and may require specific hardware and software. See apple.com/uk/ios/feature-availability/#apple-wallet-apple-pay for more information.