Allica Bank, UK’s fastest-growing fintech, planning growth with new business current account

- The Current Account Switch Service (CASS) has been used four times less by SMEs than personal customers.

- Only 0.5% of SMEs have switched bank account in the last 10 years.

- It’s time for the industry to get behind supporting CASS for SMEs to promote competition, say Allica Bank.

- Allica is ramping up its push into the business current account market with a product built specially for established SME businesses.

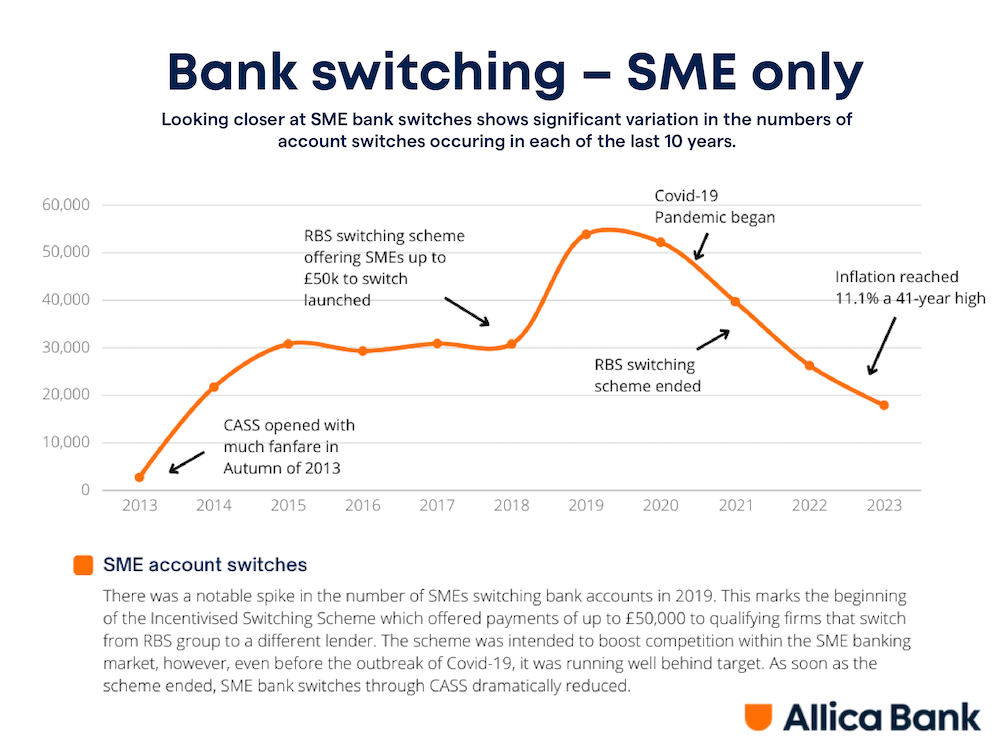

SME current account switching is now at the lowest level it’s been in the last decade.

New data analysed by Allica Bank shows disappointingly low levels of bank switching by small and medium sized businesses over the last 10 years, with less than 1% of SMEs changing their bank provider each year in this time.

The research comes as Allica ramps up efforts to gain market share amongst established SME businesses often ignored by the big banks.

Data shows that on average, around 33,000 SMEs used the Current Account Switch Service (CASS) each year over the past 10 years, the equivalent of just 0.5% of UK SMEs.

This means SME current account switching is its lowest level since the scheme began in 2013.

In 2022 there were only 26,235 SME bank account switches – with a further decline forecast in 2023 (based on latest switching rates to September 2023).

Looking back on 10 years of data shows a short-lived uplift in SME bank switching between February 2019 and June 2021. This is due to the temporary RBS-funded Incentivised Switching Scheme administered by Banking Competition Remedies.

This scheme offered businesses thousands of pounds to switch banks and created a relative boom in the SME switching market, motivating nearly 70,000 SMEs to leave RBS for a new provider.

Yet as soon as the incentives ended, the number of SMEs switching their current account dramatically dropped.

Without a compelling financial or service benefit, it seems the vast majority of SMEs can see little or no benefit to switching their bank.

This is largely down to the fact that the ‘Big Five’, do not offer any SME-specific services which would make switching worthwhile.

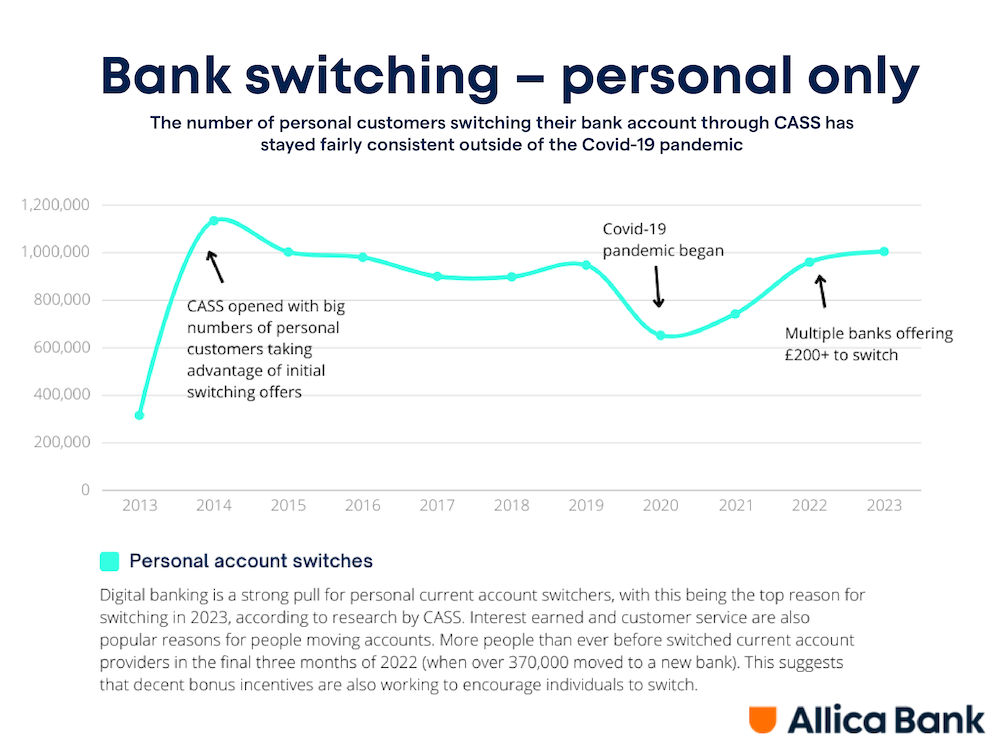

In comparison, the proportion of personal customers switching their current accounts is four times higher than SME switching rates.

Since 2020 the number of personal customers changing their bank account via CASS has steadily increased, with 2022 and 2023 switching levels being among the highest ever recorded in the scheme.

Allica Bank, which became a member of CASS in December 2023, says it launched its new business current account, the Business Rewards Account, to give established businesses compelling reasons to switch their bank account.

Allica Bank is a business bank built especially for ‘established businesses’ with over 10 employees. The bank focuses on providing tailored support to established businesses and prioritises real relationships with customers to make sure they have all the tools they need to succeed.

Allica’s products are all designed especially for SMEs, and it’s no different for the brand’s all new business current account, which offers cashback on all purchases, a dedicated relationship manager and great savings rates – all for no monthly fees.

Richard Davies, CEO of Allica Bank, said: “I wasn’t surprised to see the stats which show that minimal numbers of SME banking customers have switched their current accounts in the last decade. After all, what motivation has there been for them to do so? This is exactly why Allica Bank exists – to offer an alternative to the big banks.

“SMEs only switch when there’s a strong benefit in doing so. Our Business Rewards Account offers no account fees, cashback on all purchases, and a leading savings rate, so businesses can switch and save permanently. Our mission is to transform banking for established SMEs and we’re determined to drive change in the market – Britain’s SMEs deserve better.”