- New research has uncovered a multi-generational shift in bank lending, with a gap of up to £65bn in SME lending emerging over the last 25 years. The shortfall is especially prominent in ‘productive credit’ vital to boost investment, productivity, and growth

- There has been a particular collapse in overdraft lending to small businesses, which dropped from £18bn1 in 2000 to just £2.7bn in 2024

- The UK has the lowest business investment rate in the G7, with small businesses investing at only a third of the level of corporate businesses and the lowest level of SME loan application rates recorded in the OECD

- To reboot the market, Allica is calling on the government to expand its Growth Guarantee Schemes by three to four times, and to work with the Bank of England to revitalise the prudential framework with a stronger focus on SMEs

- Download the full report – 'Rebooting SME Finance to Unlock Growth' – here.

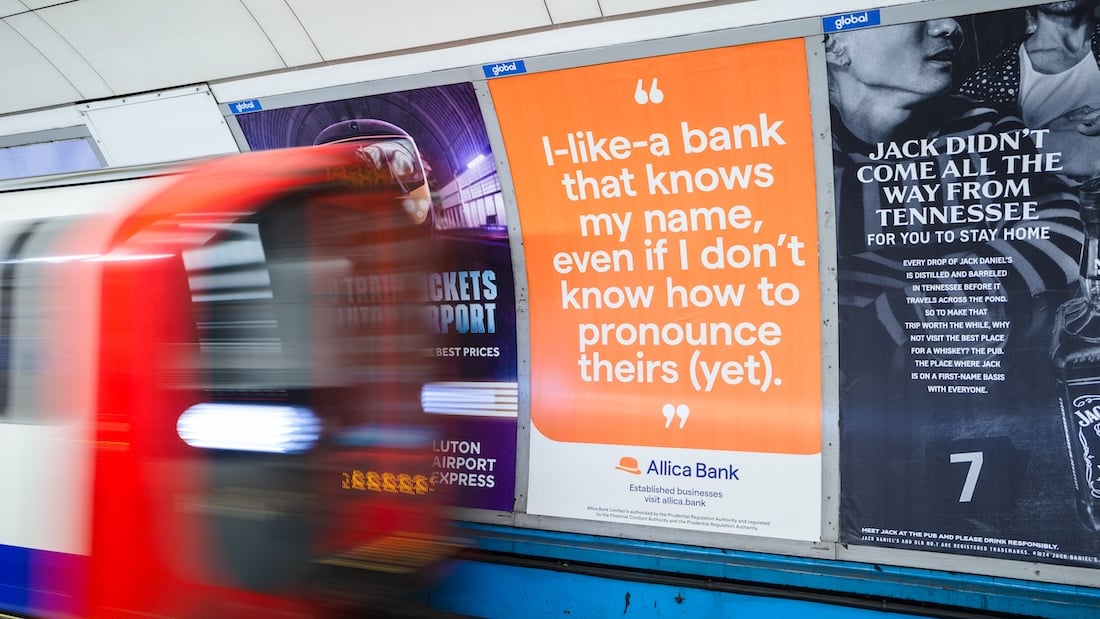

The UK’s SME lending market needs a full reboot, according to new research by the UK’s fastest growing fintech Allica Bank.

With the UK having the lowest business investment rate in the G7, the report highlights how small businesses invest at only a third of the level of large corporate businesses, with a clear link between low levels of SME finance, low investment, and weak economic growth.

Allica’s research has underlined the urgency of the government’s current SME access to finance review in helping to unlock productivity and growth in the SME sector.2

The research reveals several long-term trends, including an up to £65 billion gap in SME credit, that have developed since the financial crisis, with a significant build-up of SMEs being discouraged from seeking finance for their business.

SMEs applying for external finance has fallen markedly from 65% in the late 1980s to just 25% between 2022-24, with the UK now having some of the lowest application rates for finance from SMEs in recorded history, and the lowest application rates recorded internationally by the OECD.

Evidence also shows that SME loan rejections have risen from between 5-10% three decades ago to 40% today. Separately, the Bank of England’s 2024 SME Finance Survey found that 77% of SMEs say they would prefer to grow slowly rather than borrow to expand.

Bank lending has increasingly shifted towards collateral-backed lending – primarily real estate, but also hard assets such as vehicles and equipment. As the UK’s economy has shifted more towards the service sector (now over 80% of the economy), most companies no longer have these types of assets.

Allica’s new research also highlights a dramatic collapse in SME overdraft lending by banks. Overdrafts made up 30% of all SME finance in the late 1990s, but sit at just 5% today, creating a critical working capital gap in the SME economy.

Major policy reset is vital

Significant action must be taken now to address this position if we are to achieve the government’s mission of economic growth.

To reverse the decline and unlock SME growth, Allica Bank is calling for targeted measures, including:

- Immediately double the British Business Bank’s successful Growth Guarantee Scheme, with a longer-term plan to scale guarantee schemes by three to four times, to align with similar schemes in the US, Germany and Spain. The expansion should be focused on credit that finances productivity and growth in SMEs.

- Charge the Bank of England and the Prudential Regulatory Authority with a specific SME finance and challenger bank focus, with a remit to review the detail of the prudential framework for SME finance.

- Prioritise a cross-industry push to improve SME finance discovery, investing in both generative AI and local relationship models to help businesses navigate an increasingly fragmented market.

Richard Davies, CEO of Allica Bank, who led the research, said:

“Our research makes for stark reading, revealing just how much the SME finance market has deteriorated since the 1990s, with record low application rates from SMEs combined with bank lending that‘s focused on low risk, well-collateralised lending that does not meet the needs of the modern UK economy.

“It’s a big positive that challenger banks have stepped up over the past decade and now provide more than half of new SME lending, but the evidence is inescapable that the overall economic outcomes from the UK SME finance market have substantially worsened over recent decades.

“When you see the data over the long-term it is shocking how poorly the current UK market performs compared to both our own history and other countries.

“It’s now vital we fix the SME finance market for the long-term – not as a narrow market issue, but as a key enabler of reinvigorated UK economic growth and productivity.”

Download the full report – 'Rebooting SME Finance to Unlock Growth' – here.