Earn up to 4.33% AER1 (variable) on your business savings

Our Savings Pot is an exclusive feature of our Business Rewards Account.

1 Rate includes standard rate of 3.33% AER (minimum balance applies) plus a 0.5% boost each month if you make 15 bank transfers out of the account in the previous month, and a 0.5% boost for six months if you complete a switch with CASS. Rates correct as of 9th May 2025. ‘AER’ stands for Annual Equivalent Rate and illustrates what the interest rate would be if interest was paid and compounded once each year. See Savings Pot Key Product Information for more details.

To access our Savings Pot, you will need to open a Business Rewards Account. Terms and Conditions apply.

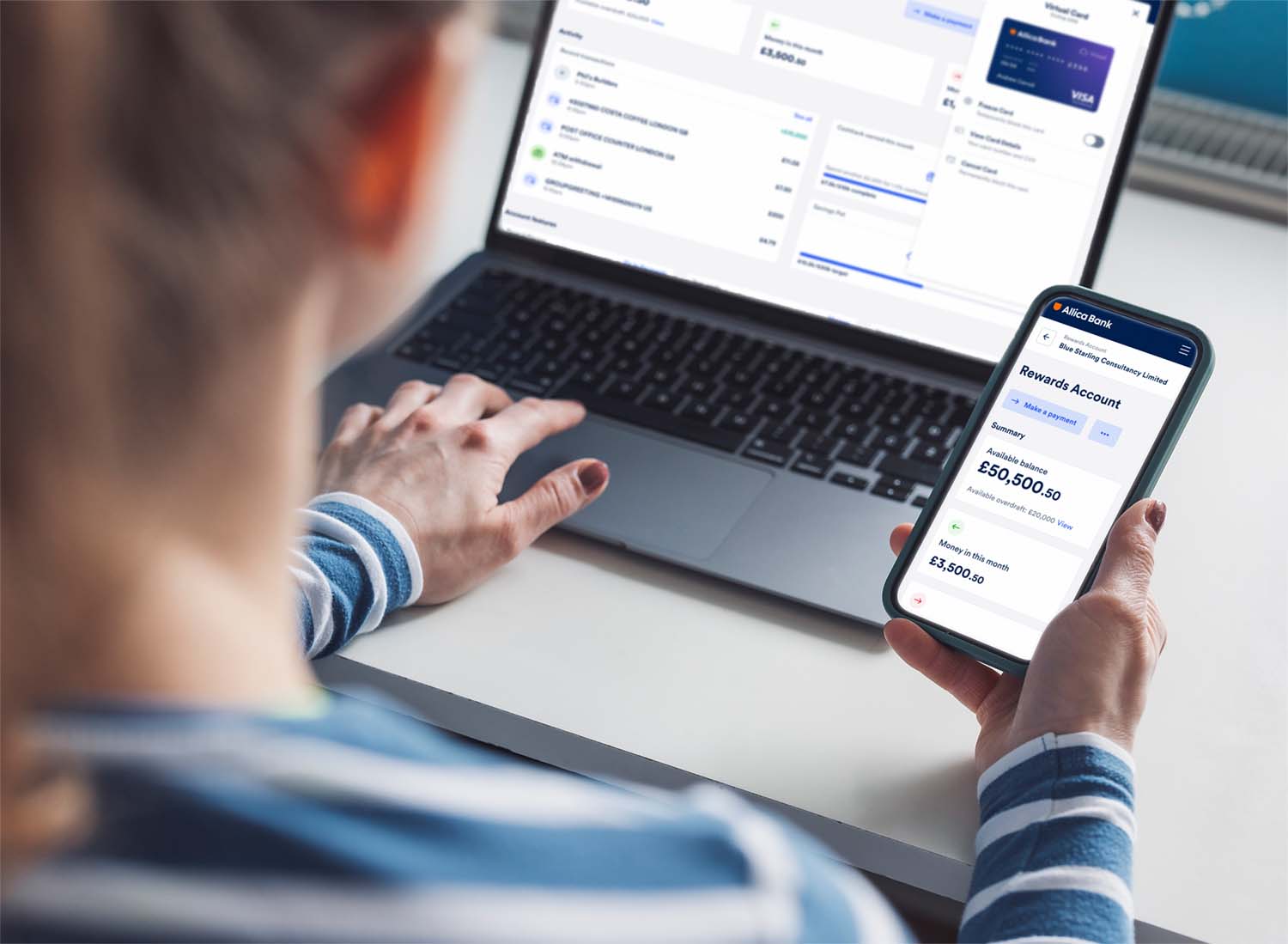

Easy to manage

Manage your money easily via our app or online banking, all backed up with UK-based phone support.

Unlimited withdrawals

Transfer money in or out of your Savings Pot as often as you like.

No more call queues

All business bank account customers get contact details for their own relationship manager.

Savings Pot

Make the most of your company's spare cash

Our Savings Pot is an exclusive feature of our Business Rewards Account. You can earn up to 4.33% AER* (variable) on savings while you continue to earn from your spending.

- Earn up to 4.33% AER1 (variable) on your company’s spare cash

- Instant access – deposit and withdraw whenever you like

- Interest paid monthly

- FSCS protected (eligible deposits only)

Business savings comparison

Get a top-tier instant access savings rate

Interest rates correct as of 21st May 2025. All rates above are variable at the time of writing.

FSCS guaranteed

All our current accounts and savings accounts are covered by the Financial Services Compensation Scheme (FSCS). This means that, should anything happen to Allica Bank, any eligible deposit of up to £85,000 will be protected.

Find out more about your eligibility for FSCS coverage here.

We’re giving established businesses the banking they deserve

Transforming relationship banking with great rates, smart people and powerful technology. It’s a new take on an old idea – just like our orange hats.

Three steps to better

business savings

It'll typically take a few days to open your Business Rewards Account, and we'll be on hand to help with any issues.

1. Fill out the form

Fill out the form below to apply for a Business Rewards Account. We’ll be in touch to complete your application.

2. Open your Business Rewards Account

If everything’s in order, your account should be open within a few days.

3. Add money to your Savings Pot

Open a Savings Pot and deposit money in it to start earning interest.

Important information

Further information about our Business Rewards Account:

- Limits, Fees, and Industry Restrictions;

- Current Account Key Product Information;

- Current Account Terms and Conditions;

- Savings Pot Key Product Information;

- Savings Pot Supplemental Terms & Conditions.

Eligibility

Our Business Rewards Account is a current account designed for established businesses who:

- are incorporated for a minimum of 12 months

- keep a balance of £50,000 or more in their account

- or have a loan product with us

See Key Product Information for further information.

Let's put your money to work

Fill out the form and we'll be in touch to complete your application.

Keep in mind: Our Business Rewards Account is designed for established businesses who keep a balance of £50,000 or more in their account. See our eligibility criteria.

You’ve got questions.

We’ve got answers.

What type of savings account is this?

Allica’s Savings Pot is part of our business current account – the Business Rewards Account. To access our Savings Pot, you will need to open a Business Rewards Account.

What interest rate can I get with Allica?

Allica’s Savings Pot earns a standard rate of 3.33% AER* (variable), which can be boosted by up to 1% with Savings Pot Boosts. This includes a 0.5% boost each month if you make 15 bank transfers the previous month, and a 0.5% boost for six months if you complete a successful switch with the Current Account Switch Service (CASS). See our Savings Pot Key Product Information for more details.

What is AER?

‘AER' stands for ‘annual equivalent rate' and is designed to make it easy for you to compare savings products. It illustrates what the interest rate would be if interest was paid and compounded once each year.

Can I access my money at any time?

If you typically keep a balance of £50,000 or already have a loan with us, you can transfer money in and out of your Business Rewards Account Savings Pot as much as you like with no monthly fees. Businesses keeping less than that in the account may incur fees.

Can the interest rate change?

Yes. The interest rate on the Savings Pot is variable. If the interest rate decreases, we'll tell you at least 14 days before it changes. If it increases, we'll notify you within 30 days of the change.

How can I open a Business Rewards Account?

Our business current account is designed for businesses who are incorporated for 12 months and typically keep a balance of £50,000 or more in the account, or for existing Allica customers who have a loan with us. Apply online here.

Expand for more answers +