How business banking used to be – just better

Explore our business bank account

- Earn up to 4.33% AER1 (variable) on instant access savings

- No monthly fees + up to 1.5% cashback2

- A relationship manager you can count on

Subject to Eligibility. Terms and Conditions apply.

1 Rate includes standard rate of 3.33% AER (minimum balance applies) plus a 0.5% boost each month if you make 15 bank transfers out of the account in the previous month, and a 0.5% boost for six months if you complete a switch with CASS. Rates correct as of 9th May 2025. ‘AER’ stands for Annual Equivalent Rate and illustrates what the interest rate would be if interest was paid and compounded once each year. Subject to eligibility – see Savings Pot Key Product Information for more details.

2 Cashback is variable based on eligibility and spend. See a full list of limits and fees here.

A more rewarding business bank account,

made for established businesses

Established businesses are firms with 5–250 employees. They're a vital part of our communities but they’re being let down by the big banks. Allica was built specifically to meet the unique needs of businesses like these.

Savings pot

Help your money make money

Don’t leave your company cash sitting idle. Transfer it into your current account’s instant access Savings Pot and start earning up to 4.33% AER1 (variable). Deposit and withdraw for free any time.

A business bank for established businesses

Established businesses are those firms with 5–250 employees. A vital part of our communities, they employ a third of the UK workforce and contribute a third of GDP. But they’re being let down by the big banks. Allica was built specifically to meet the unique needs of businesses like these.

Tools that make business banking a breeze

Take control of your banking. Allica’s business current account makes managing your money easy, transparent and secure. And there’ll always be someone there to help if you need them.

Assisted account opening

One of our team will help you open your account. Typically, it’ll only take a few days.

Easy money management

Track your company spending and the interest you’ve earned in online banking and our app.

Share access with your team

Add users to your account with controls on what they can do and how much they can spend.

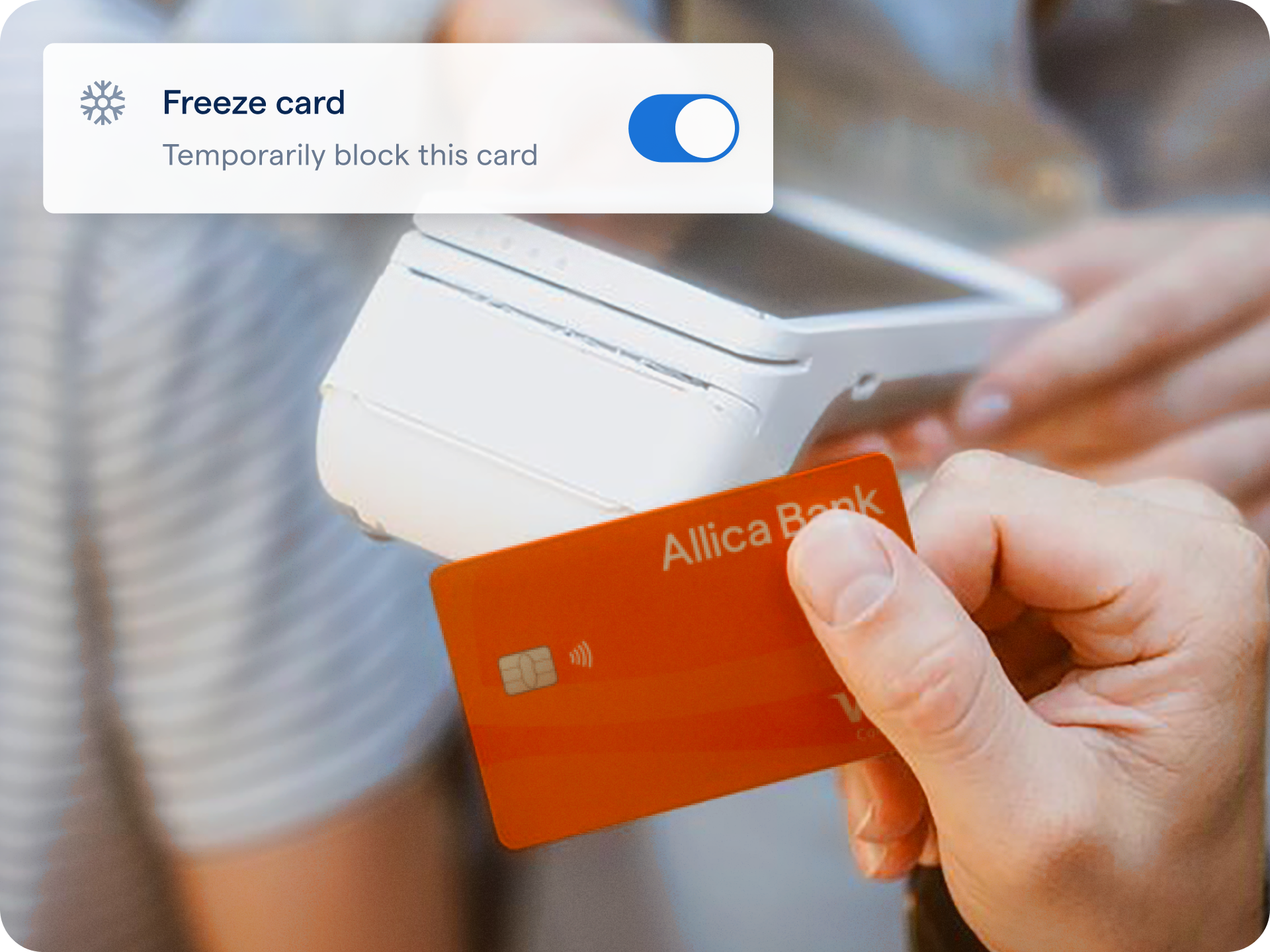

Full card control

Easily order and block payment cards to help keep your account secure.

UK-based human support

Get help from our UK customer service team and your dedicated relationship manager.

One of our team will help you open your account. Typically, it’ll only take a few days.

Track your company spending and the interest you’ve earned in online banking and our app.

Add users to your account with controls on what they can do and how much they can spend.

Easily order and block payment cards to help keep your account secure.

Get help from our UK customer service team and your dedicated relationship manager.

Switching accounts is easier than you think

It's hassle-free with the Currect Account Switch Service. Details

Sync with your accounting tools

Connect with Sage or Xero to automatically sync all your transaction activity.

Available online, iOS and Android

Easily manage your Business Rewards Account on the web or mobile app.

Sync with your favourite accounting tools

Save time by connecting your Allica Bank current account with your accounting software and automatically sync all your transaction activity.

![]()

Available online, iOS or Android

Easily manage your Business Rewards Account on the web or by using our mobile app.

SUPPORT

Great rewards. Great tools. Even better Matts.

SUPPORT

Great rewards. Great tools. Even better Katies.

SUPPORT

Great rewards. Great tools. Even better Rickys.

SUPPORT

Great rewards. Great tools. Even better Peters.

We believe in banking the way it used to be. That means a dedicated relationship manager and UK customer support team to help you get the most out of your bank account.

- A direct line to your own relationship manager

- No more call centres

- A partner who understands your business

.jpg?width=1000&height=1000&name=meet-katie%20(1).jpg)

List of features

Our Business Rewards Account

is the business bank account that rewards you

Click below to see full details, including transaction limits, cards, account fees, withdrawals, security, and more.

FSCS guaranteed

All our current accounts and savings accounts are covered by the Financial Services Compensation Scheme (FSCS). This means that, should anything happen to Allica Bank, any eligible deposit of up to £85,000 will be protected.

Find out more about your eligibility for FSCS coverage here.

See the difference a better bank can make

Gentle Dog Food are getting a great return on their company savings

Relationship Manager: Matt West Location: South West

AgeCare are investing their extra savings interest back into their business

Relationship Manager: Luke Veale Location: South East

Whitewater Creative switched

all their banking to Allica

Relationship Manager: Emily Hopkins Location: South East

We’re giving established businesses the banking they deserve

Transforming relationship banking with great rates, smart people and powerful technology. It’s a new take on an old idea – just like our orange hats.

Applying starts simple

and then gets simpler

It'll typically take a few days to open your account, and we'll be on hand to help with any issues.

1. Fill out the form

Click ‘Apply now’ below and fill out a few details.

2. We’ll have a quick call

We’ll ring you to finish your application and answer any questions you have.

3. And you’re away

So long as everything’s in order, your account should be opened within a few days.

Eligibility

Our Business Rewards Account is a current account designed for established businesses who:

- are incorporated for a minimum of 12 months

- keep a balance of £50,000 or more in their account

- or have a loan product with us

See Key Product Information for further information.

Apply now

Fill out the form and we'll be in touch to complete your application.

Keep in mind: Our Business Rewards Account is designed for established businesses who keep a balance of £50,000 or more in their account. See our eligibility criteria.

You’ve got questions.

We’ve got answers.

Who are Allica Bank?

Allica are a no-nonsense bank built specifically to give established businesses with between 5 and 250 employees the banking they deserve.

We got our banking licence in 2019 and have grown quickly since then, being named in the 2024 Sunday Times 100 list of fastest-growing private companies. Allica has offices in Milton Keynes, London and Manchester, and relationship managers up and down the country helping to give established businesses the banking they deserve.

How do I apply for a business current account

You can open a Business Rewards Account with Allica by completing our online application. We’ll then give you a quick call to finish your application and answer any questions you have. So long as everything’s in order, your account should be opened within a few days.

Is Allica Bank’s business current account protected by FSCS (Financial Services Compensation Scheme)?

Yes! All our current accounts and savings accounts are covered by the Financial Services Compensation Scheme (FSCS). This means that, should anything happen to Allica Bank, any eligible deposit of up to £85,000 will be protected.

Keep in mind this compensation covers all your accounts with Allica Bank , not each individual account. For example, if you have a total of £100,000 in two separate accounts with Allica Bank, the maximum compensation you could claim on your Allica’s deposits through FSCS is £85,000.

Find out more about your eligibility for FSCS coverage here.

How long does it take to open a business current account?

Once you’ve made your application, we’ll aim to have your account open in just a few working days.

How can I earn cashback?

You can earn cashback by making payments on your Allica Bank card.

You will get 1% cashback on all eligible card payments – this could include train tickets, magazine subscriptions, fuel, or even your online advertising spend. If you spend £10,000 in a month, all subsequent payments that month will earn a cashback rate of 1.5%!

There are a few types of transaction that won’t qualify for cashback, such as cash withdrawals or buying foreign currency. You can find a full list of these here.

Can you have more than one business bank account?

Yes, businesses can have multiple bank accounts.

You can also open multiple Business Rewards Accounts with Allica to help you manage your money. And you won’t need to apply for each one. Once you’ve opened your first account with Allica you can easily open an additional account without having to make another application.

Expand for more answers +

Help, my question isn’t answered here.

Don’t worry, find the answer in our Help Centre or speak to our team on 0330 094 3333.