Call us

0330 094 3333

9am - 5pm Monday-Friday

Been in business for a year? Explore a current account designed especially for established businesses that comes with a dedicated relationship manager. We've also got satisfying savings rates and a wide range of lending products.

Been in business for a year?

Explore a current account for established SMEs that comes with a relationship manager. Choose from satisfying savings rates and flexible lending products too.

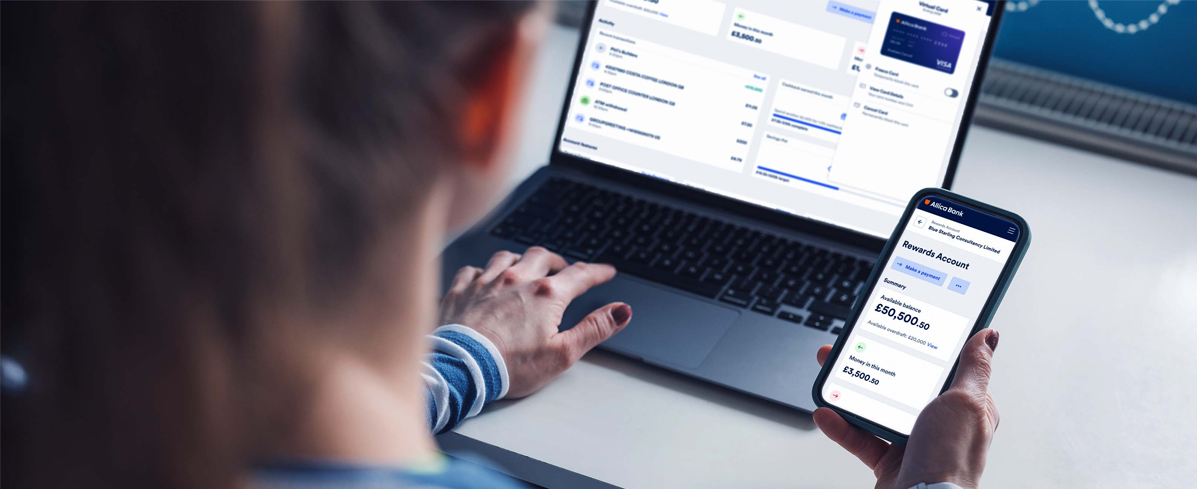

Get your money hat on with Allica Bank – the business bank built especially for established businesses.

With a dedicated relationship manager, every Allica Bank current account customer can expect no monthly fees, no faff, and no more spending hours on hold.

What’s more, we’ve got some of the best business savings rates on the market.

So stop being held back by your bank, and get your money hat on with Allica Bank.

Learn more

Learn more

Learn more

Learn more

Learn more

* ‘AER' means ‘annual equivalent rate' and is designed to make it easy for you to compare savings products. It tells you how much interest you'd earn if you put some money in an account and left it there for a full year. It takes account of things like how often the interest is paid and assumes any interest paid during that year is added to the balance and earns interest.

**See a full list of limits, fees, and industry restrictions here or read our key features document or service information.

*See a full list of limits, fees, and industry restrictions here, or our current account key product information, or terms & conditions, or savings pot key product information, or supplemental terms & conditions.

Rate correct as of 1st March 2024. 'AER' stands for Annual Equivalent Rate and illustrates what the interest rate would be if interest was paid and compounded once each year. Businesses keeping less than £50,000 in the account may earn a reduced rate of interest and may incur fees.

Terms and conditions apply – click to read more.

Your eligible deposits with Allica are protected up to a total of £85,000 by the Financial Services Compensation Scheme, the UK's deposit guarantee scheme. Any deposits you hold above the limit are unlikely to be covered.

Find out more about your eligibility for FSCS coverage here.

Earn over 5%* AER on your savings

Simple online application

Fixed-term and notice accounts available

Learn more

Learn more

Learn more

Learn more

* 5% AER, fixed term deposits only. Min deposit £20k, max £2mil. T&Cs apply Find out more here.

**Rate correct as of 1st march 2024. 'AER' stands for Annual Equivalent Rate and illustrates what the interest rate would be if interest was paid and compounded once each year.

***See a full list of limits, fees, and industry restrictions here or read our key features document or service information.

Read now

Read now

Read now

excellent interest rate on the savings account. Looking forward to when they will integrate with Xero so that I can ditch our existing current account provider totally!

What a refreshing approach to banking. Amazing Customer service provided by our account manager Luke Veale. The account was really easy to open, quick response times and best of all high % on savings account better than any offered by our normal business bank that we have been with for 20 years. So good to have a proactive approach

The calling officer knew what he was talking about and it was a breaze to go through Complaince and Money Laundering issues. The account itself was opened in 24 hours not the weeks, months it takes with any other UK bank. The service is perfect - if there are questions these are anwered in hours

Great SME bank account - will literally save us £'000s per year through the cashback offering and interest rate on savings. Decent relationship manager to who took the time to phone and discuss any other needs we might have.

Great interest rates, cashback on direct debit transactions, no charges for bacs payments and no monthly charges unlike my other business accounts with RBS. Customer service is also excellent.

Easy to set up account, Matt was and remains available for any queries ( we only had one small hiccup but was dealt with same day by phone ) which is very rare this day to get to speak to a person who knows what they are meant to do, will recommend to friends

excellent interest rate on the savings account. Looking forward to when they will integrate with Xero so that I can ditch our existing current account provider totally!

What a refreshing approach to banking. Amazing Customer service provided by our account manager Luke Veale. The account was really easy to open, quick response times and best of all high % on savings account better than any offered by our normal business bank that we have been with for 20 years. So good to have a proactive approach

The calling officer knew what he was talking about and it was a breaze to go through Complaince and Money Laundering issues. The account itself was opened in 24 hours not the weeks, months it takes with any other UK bank. The service is perfect - if there are questions these are anwered in hours

Great SME bank account - will literally save us £'000s per year through the cashback offering and interest rate on savings. Decent relationship manager to who took the time to phone and discuss any other needs we might have.

Great interest rates, cashback on direct debit transactions, no charges for bacs payments and no monthly charges unlike my other business accounts with RBS. Customer service is also excellent.

Easy to set up account, Matt was and remains available for any queries ( we only had one small hiccup but was dealt with same day by phone ) which is very rare this day to get to speak to a person who knows what they are meant to do, will recommend to friends

excellent interest rate on the savings account. Looking forward to when they will integrate with Xero so that I can ditch our existing current account provider totally!

What a refreshing approach to banking. Amazing Customer service provided by our account manager Luke Veale. The account was really easy to open, quick response times and best of all high % on savings account better than any offered by our normal business bank that we have been with for 20 years. So good to have a proactive approach

The calling officer knew what he was talking about and it was a breaze to go through Complaince and Money Laundering issues. The account itself was opened in 24 hours not the weeks, months it takes with any other UK bank. The service is perfect - if there are questions these are anwered in hours

Great SME bank account - will literally save us £'000s per year through the cashback offering and interest rate on savings. Decent relationship manager to who took the time to phone and discuss any other needs we might have.

Great interest rates, cashback on direct debit transactions, no charges for bacs payments and no monthly charges unlike my other business accounts with RBS. Customer service is also excellent.

Easy to set up account, Matt was and remains available for any queries ( we only had one small hiccup but was dealt with same day by phone ) which is very rare this day to get to speak to a person who knows what they are meant to do, will recommend to friends

excellent interest rate on the savings account. Looking forward to when they will integrate with Xero so that I can ditch our existing current account provider totally!

What a refreshing approach to banking. Amazing Customer service provided by our account manager Luke Veale. The account was really easy to open, quick response times and best of all high % on savings account better than any offered by our normal business bank that we have been with for 20 years. So good to have a proactive approach

The calling officer knew what he was talking about and it was a breaze to go through Complaince and Money Laundering issues. The account itself was opened in 24 hours not the weeks, months it takes with any other UK bank. The service is perfect - if there are questions these are anwered in hours

Great SME bank account - will literally save us £'000s per year through the cashback offering and interest rate on savings. Decent relationship manager to who took the time to phone and discuss any other needs we might have.

Great interest rates, cashback on direct debit transactions, no charges for bacs payments and no monthly charges unlike my other business accounts with RBS. Customer service is also excellent.

Easy to set up account, Matt was and remains available for any queries ( we only had one small hiccup but was dealt with same day by phone ) which is very rare this day to get to speak to a person who knows what they are meant to do, will recommend to friends

Established businesses make up 30% of the UK economy, but are often getting a raw deal from their bank. Allica Bank is on a mission to give established businesses the banking they deserve.

We do this through a unique mix of real human expertise and powerful technology.

Based out of our offices in Milton Keynes, London and Manchester, Allica has relationship managers out on the road up and down the country helping businesses like yours.

Speak to one of our team to find out how we might be able to help your business.

9am - 5pm Monday-Friday

Allica Bank Limited is authorised by the Prudential Regulation Authority and regulated by the Financial Conduct Authority and the Prudential Regulation Authority (FRN: 821851). Registered office: 4th Floor, 164 Bishopsgate, London EC2M 4LX. Registered in England and Wales with company number 07706156.

Allica Bank savings accounts and business current account products are regulated by the Financial Conduct Authority and the Prudential Regulation Authority. Allica Bank lending products are not regulated products.

Asset finance and growth finance services are provided by Allica Financial Services Limited trading as Allica Bank Asset Finance. Registered office: 4th Floor, 164 Bishopsgate, London EC2M 4LX. Incorporated under the laws of England and Wales with company number 12784979. Allica Financial Services Limited is not authorised or regulated by the Prudential Regulation Authority or the Financial Conduct Authority. The asset finance and growth finance products offered by Allica Bank Asset Finance are not regulated products.