- Businesses

- Savers

- Introducers

- About us

- Resources

-

Login

-

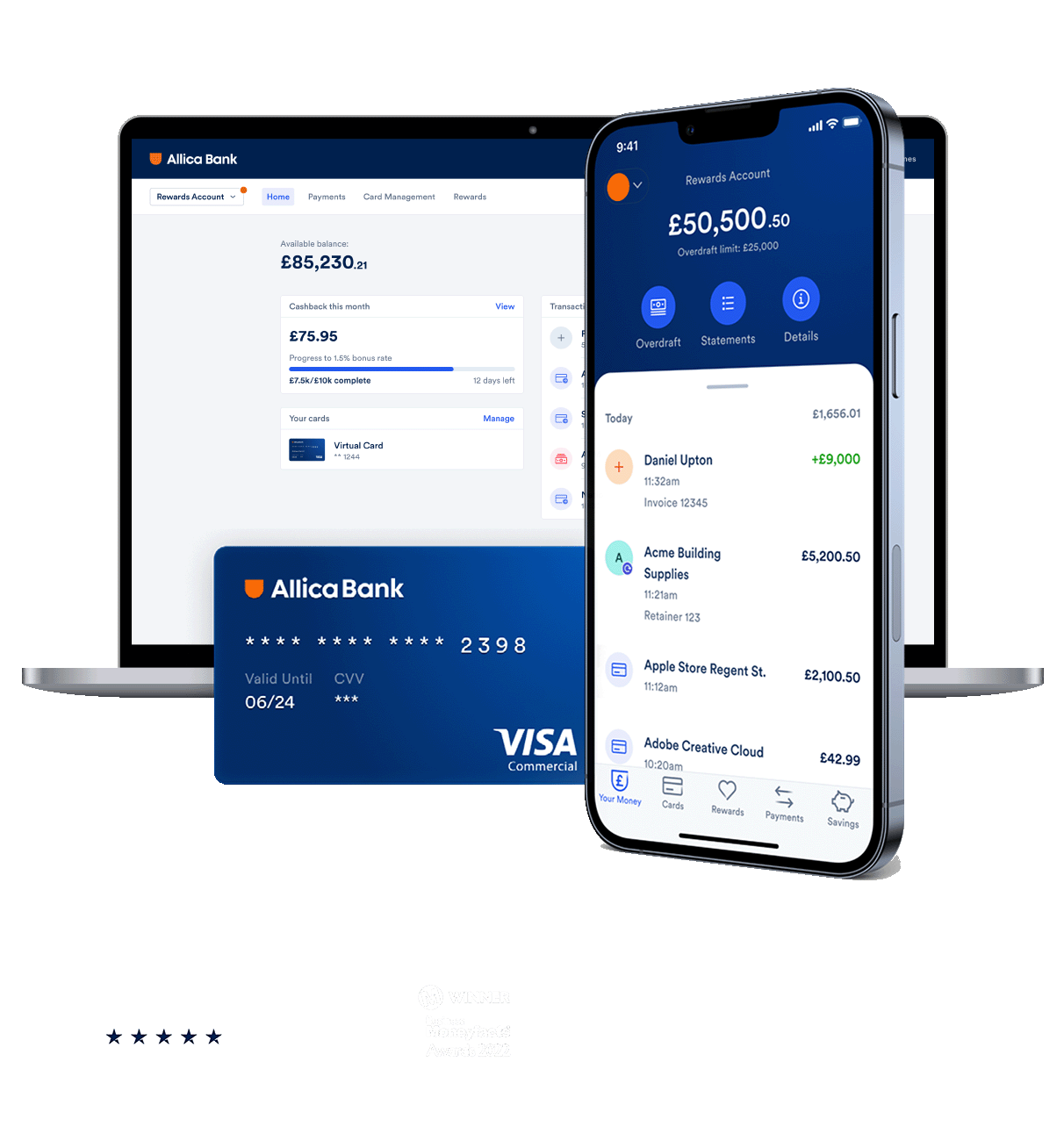

Online banking

- Personal

- Business

-

Introducer Portal

- Commercial mortgage brokers

- Asset finance partners / brokers

-

-

Businesses

-

Savers

- Introducers

-

About us

-

Resources

-

Login

-

Online banking

- Personal

- Business

-

Introducer Portal

- Commercial mortgage brokers

- Asset finance partners / brokers

-

-

Help & FAQs

-

Contact us